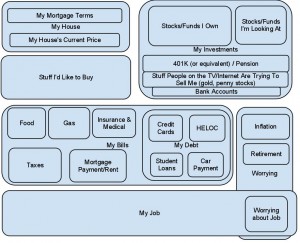

Traders don’t look at the world the same way “normal” people do. This applies both to the world at large, and more specifically to the world of finance. For the purpose of this post, I’m only interested in that more narrow subject – how traders view the world of finance. The easiest way to understand this is to look at a couple of pictures. Below is a Venn diagram of how I think Joe Sixpack views his finances:

This won’t be the same for everyone obviously, but the basic structure seems to be fairly constant from person to person. That’s not a scientific claim, just something I’ve observed. I tried to make the relative size of the boxes reflect the amount of time and energy the typical person puts into thinking about each topic. Again, this will vary from person to person and I’m sure I’ve forgotten a few things.

This won’t be the same for everyone obviously, but the basic structure seems to be fairly constant from person to person. That’s not a scientific claim, just something I’ve observed. I tried to make the relative size of the boxes reflect the amount of time and energy the typical person puts into thinking about each topic. Again, this will vary from person to person and I’m sure I’ve forgotten a few things.

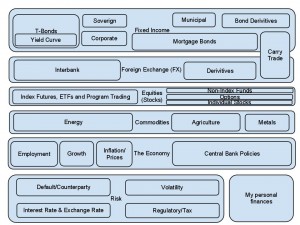

Now, there’s nothing wrong with this view of finance. It’s well suited to the mundane aspects of making ends meet on a day to day basis. But I think it’s horribly suited to thinking about trading. Here’s an analogous Venn Diagram for the way a trader thinks about finance:

Again, box size indicates level of thought and everything is only approximate. But even a casual comparison shows it to be radically different the the first diagram.

Again, box size indicates level of thought and everything is only approximate. But even a casual comparison shows it to be radically different the the first diagram.

- Perhaps the biggest difference is that Joe Sixpack’s diagram is self centered, whereas the trader is an outside observer. Joe is concerned about HIS house, HIS job, HIS stocks. The trader is concerned about houses (really, mortgages), employment, and stocks. These things are of interest to the trader even when they belong to other people, since their behavior is a source of potential profit or loss. This is not to say that traders don’t worry about their own personal finances – they do. But it’s a side activity, not the main show.

- The trader sees a much more intricate financial machine than Joe. There are 16 bubbles on the Trader’s diagram that represent types of financial instruments. There are only 3 on Joe’s, and one of them involves TV infomercials. A big part of becoming a trader is learning the function of all major financial instruments at a deep level.

- Joe Sixpack’s view of investment centers on stocks. The trader’s centers on bonds and to a lesser extent index futures. Individual stocks are of minor concern, and there’s a good reason for this. Consider the stock of a large and well known company like Microsoft (MSFT). As of last Friday’s close, the total market capitalization of MSFT (the stock price times the number of outstanding shares) is just shy of 220 Billion dollars. That’s a lot of money. Actually, it’s a mind-bogglingly huge mount of money. But it’s nothing compared to the number of outstanding US treasury bonds, which right now amount to over $8 Trillion, almost $15T if you count bonds held by various federal trust funds. Using the lower number, that’s about 36x as much as MSFT’s market cap. Point being, when money moves in and out of T-bonds, it has a much bigger effect on the rest of the world then when money moves in and out of MSFT. That’s why traders care so much about bonds, even if they don’t trade them directly. In order to get stock to play on the same level, you’d have to combine the stocks of most US-traded companies together. That’s what index futures do – they provide a way to trade the entire $10T market cap of the S&P500 stocks (which are the vast majority of big US stocks) as one entity. This lets stocks operate on a scale similar to bonds, but at the cost of individuality. You’re not longer trading an individual stock, but rather a featureless puree of stock.

For similar reasons, traders are interested in the foreign exchange (currency) markets, mortgage bond market, and certain commodities (in particular, oil and food). Each of those market is far bigger, and thus far more relevant to the economy, than any one stock.

- The trader sees risk as a key element of finance. Risk, simply put, is the fact that something could go wrong. The study of risk consists of understanding under what circumstances that will happen, and how likely those circumstances are. It is a difficult and demanding intellectual discipline, but everything starts with the simple acknowledgement that something MIGHT go wrong. In fact, at the end of the day risk, and its flip side return, is the primary driver of market transactions. Between 50% and 85% of the minute-to-minute movement of most major markets can be explained simply by a change in the desire to take risks to seek return. Risk, and its emotional stand-in fear, move the market.

There’s probably more to be said about the trading mindset, but hopefully you get the idea. The first task a would-be trader has to accomplish is not to learn a trading method. Nor is it acquiring sufficient capital or putting in place risk control, as important as those things are. The first task is to re-structure your thinking from the first picture to the second – to adopt the trader’s mindset. This is not easy to do – I think it’s typically a multi-year process, although immersion can speed that up. But if you want to become a successful trader this is a change you’re going to have to make. Which of course raises the obvious question: how do you change mindsets?

I think one of the most effective ways is simply to read things written by traders, especially things that are NOT intended for general audience. When trader talk/write among themselves they use a jargon that stems directly from the trader mindset. You can learn the mindset by understanding the jargon. Whenever you’re reading along and don’t understand what’s being said, look it up. Investopedia is a good resource for looking up most things, although I’d be careful not to buy anything they’re selling in their ads. Of course, this method requires a large source of trader writings to read and there you can run into problems. The major trading forums and blogs on the web are in my opinion populated by deeply negative people – elitetrader.com and zerohedge.com in particular. You can learn the trader mindset by reading them, but it might also motivate you to slit your wrists. The forums here will serve as an alternative once I get a community built up. Another good source of trading discussion are the Market Wizards books – original and new. These are about as close as you’re going to get to top traders telling you how they make money. If you understand everything that’s said and implied in those books, you’ll have achieved the trader’s mindset. They were written in the late 80s and early 90s, and don’t include the latest products in information, but surprisingly little has actually changed in that time.

Another way to change your mindset it to work or just hang around traders. Try to get a job at a financial institution with a trading desk, even if your job isn’t a trading job. Join local traders clubs. Talk with your friends who are interested in trading.

Changing your mindset is a long process, but it’s one that has to happen if you want to make money as a trader. Might as well get started now.