Somewhere along the way someone probably told you not to play the lottery – that it’s a dumb idea. And this is true. The typical state lottery pays out about 50% of the money it takes in as prizes. The other 50% is retained by the state to build parks or educate kids or some such nonsense 😉 It’s no exaggeration to say that lotteries are a tax on people that are bad at math – a sort of tax I heartily approve of.

There’s an interesting intersection between trading and lotteries you may not have thought about. One aspect of a lottery is the deficient payout – in the typical case $0.50 is paid out for every $1 payed in. In other words playing the lottery has a profit factor of 0.5. Another aspect is the extreme imbalance of payouts – infrequent huge wins paired with frequent small losses. This later aspect is what I want to investigate today – especially the idea of lotteries where the payoff is greater than pay-in. In other words, “good” lotteries.

If you haven’t read the profit factor and first Kelly criterion articles, I suggest you do so before continuing.

This is one of those tasks where it’s just easiest to let Excel do the work for you. So I created a series of bets, each with a profit factor of 2.0 that have different probabilities ( P(win) )of winning. Thus they have inversely varying payoff odds to compensate for the varying P(win). These are all in some sense good, profitable bets. The bets with low P(win) represent mild lotteries. The bets with P(win) much greater than 0.5 represent what I term “reverse lotteries” – bets where you frequently win a small amount and infrequently lose a big amount. For each one, I calculated the ideal Kelly bet size, and then what the expected return from one bet in terms of bankroll faction. Here are the results:

| Payoff Odds | P(win) | Profit Factor | Expectation | Kelly Fraction | Return in Bankroll % From One Bet |

| 38.00 | 0.05 | 2.00 | 0.95 | 0.03 | 2.4% |

| 18.00 | 0.10 | 2.00 | 0.90 | 0.05 | 4.5% |

| 11.33 | 0.15 | 2.00 | 0.85 | 0.08 | 6.4% |

| 8.00 | 0.20 | 2.00 | 0.80 | 0.10 | 8.0% |

| 6.00 | 0.25 | 2.00 | 0.75 | 0.13 | 9.4% |

| 4.67 | 0.30 | 2.00 | 0.70 | 0.15 | 10.5% |

| 3.71 | 0.35 | 2.00 | 0.65 | 0.18 | 11.4% |

| 3.00 | 0.40 | 2.00 | 0.60 | 0.20 | 12.0% |

| 2.44 | 0.45 | 2.00 | 0.55 | 0.23 | 12.4% |

| 2.00 | 0.50 | 2.00 | 0.50 | 0.25 | 12.5% |

| 1.64 | 0.55 | 2.00 | 0.45 | 0.28 | 12.4% |

| 1.33 | 0.60 | 2.00 | 0.40 | 0.30 | 12.0% |

| 1.08 | 0.65 | 2.00 | 0.35 | 0.33 | 11.4% |

| 0.86 | 0.70 | 2.00 | 0.30 | 0.35 | 10.5% |

| 0.67 | 0.75 | 2.00 | 0.25 | 0.38 | 9.4% |

| 0.50 | 0.80 | 2.00 | 0.20 | 0.40 | 8.0% |

| 0.35 | 0.85 | 2.00 | 0.15 | 0.43 | 6.4% |

| 0.22 | 0.90 | 2.00 | 0.10 | 0.45 | 4.5% |

| 0.11 | 0.95 | 2.00 | 0.05 | 0.48 | 2.4% |

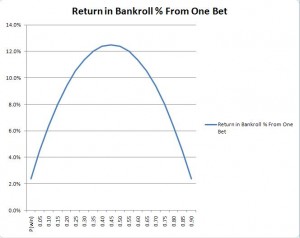

If you’re looking for an opportunity to practice your Kelly math, regenerating this table would be a good excercise. Here’s the last column plotted against P(win):

What you get is an interesting effect. While all the bets have the same profit factor, they do NOT generate the same rate of bankroll growth. The bets with a P(win) of about 0.5 are much better. The reason for lies in the math of the Kelly Criterion. The Kelly Criterion tries very hard to keep you from going near-broke by scaling back your bets. Both lotteries and reverse lotteries work against that goal – with lotteries, you may go a large number of bets without a win thus risking a large drawdown. Reverse lotteries have the potential for a single big loss to cause a large drawdown. As such in both cases Kelly has to scale back the bet sizes more than you might like. It turns out that both effects are equally bad in terms of bankroll growth rate. Assuming you hold profit factor constant, what you really want is bets that have a P(win) of exactly 0.5 – meaning the typical win would be Profit Factor * typical loss.

This math has a lot of implications both for trading system design and for business activities in general. The trading system takeaway is that you should try to design systems that have about equal numbers of wins and losses with bigger wins than losses. Deviating from this a little bit – say withing the range 0.35 < P(win) < 0.65 – doesn’t have much negative effect. But go too much farther one way or the other, and your bankroll growth slows substantially.

The general business takeaway is perhaps more interesting if harder to implement. The best business bets, all else equal, are those that fail half the time. This of course assumes constant profit factor – meaning I’m talking about good, positive expectations bets in all cases. But given the choice, you should seek out those medium-risk bets, size them according to Kelly (or less, to reduce volatility), and your business will grow at maximal rate. Obviously bet sizing and bet evaluation is much more difficult in conventional business than it is in gambling or trading, but you should keep the concept in mind and look for this sort of 50% chance of success opportunities. It’s far too easy in business to seek out near-sure things and over-bet on them (for conservative firms), or alternately to bet on colossal long shots with huge payoffs (for startups). Kelly tells you both those strategies are bad ideas – you should avoid both lotteries and reverse lotteries, and seek out opportunities in the middle.