We have a couple trades in the speculative alternatives portfolio that should have happened last week, but I was being a total slacker and din’t post them. The changes: Continue reading

Author Archives: W

Kelly Criterion Part 2: Avoid Lotteries and Reverse Lotteries

Somewhere along the way someone probably told you not to play the lottery – that it’s a dumb idea. And this is true. The typical state lottery pays out about 50% of the money it takes in as prizes. The other 50% is retained by the state to build parks or educate kids or some such nonsense 😉 It’s no exaggeration to say that lotteries are a tax on people that are bad at math – a sort of tax I heartily approve of.

There’s an interesting intersection between trading and lotteries you may not have thought about. One aspect of a lottery is the deficient payout – in the typical case $0.50 is paid out for every $1 payed in. In other words playing the lottery has a profit factor of 0.5. Another aspect is the extreme imbalance of payouts – infrequent huge wins paired with frequent small losses. This later aspect is what I want to investigate today – especially the idea of lotteries where the payoff is greater than pay-in. In other words, “good” lotteries.

Choosing The Right Broker

Most of my readers, like me, approach trading from a retail perspective. A “retail trader” is a person that executes trades through a broker. The alternative is an “institutional trader” – someone who is part of a company that has their own exchange memberships and clearing ability and thus can function as their own broker. So if you’re going to operate as a conventional retail trader, you need a broker. And it turns out that choosing a broker is very complicated. What makes it worse is that you have to choose a broker before you can gain any real trading experience. So traders are at the most ignorant point in their careers when they have to make this important decision. I’m going to walk you through some aspect of the process, and hopefully at the end you’ll know enough to proceed. Continue reading

Monkey Math Part 1 – Deciding If Trading Systems Work

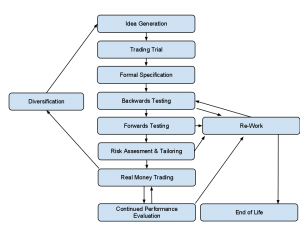

I realized this morning that it’s been almost an entire year since I wrote about the trading system development process pictured at right. That’s almost criminal, because in all that time I’ve never really gotten around to explaining the heart of the system development process: testing systems to make sure they work, and refining them when they don’t. This corresponds to the formal specification, backwards/forwards testing & re-work boxes in the diagram.

I realized this morning that it’s been almost an entire year since I wrote about the trading system development process pictured at right. That’s almost criminal, because in all that time I’ve never really gotten around to explaining the heart of the system development process: testing systems to make sure they work, and refining them when they don’t. This corresponds to the formal specification, backwards/forwards testing & re-work boxes in the diagram.

These steps are in some sense the most dangerous parts of system development process because it’s easy to fool yourself into thinking a system works when it doesn’t. Continue reading

Speculative Alternatives Portfolio Update – 10/22/2012

We have transactions in the speculative alternatives portfolio today. Continue reading

Mathematical Literacy And Trading

A little over a week ago I posted on the topic of the Kelly Criterion and its use in bet sizing. This post was notable for being the most mathematically sophisticated material I’ve covered thus far. On previous topics I’ve made some effort to hide the math – sort of like those cooking shows where they pull a fully baked cake from the oven immediately after putting the pan full of batter in. There are upsides and downsides to hiding the math this way, but I’m starting to think the downsides outweigh the upsides. Continue reading

The Difference Between Academic Econometrics and Quantitative Finance

I’m going to admit something few people know about me: I love arguing on the internet and engaging in sophisticated trolling. I’m certainly not the only person to feel this way, but I may be one of the few people to openly admit it. The public perception of online argument is that it’s at best a waste of time, inevitably self demeaning (see right), and at worst horribly antisocial and divisive. Since the people I argue with are always anonymous and present of their own free will, I really don’t give a shit about the later two points. But I would suggest that arguing on the internet and broader behavior of the same sort are actually one of the best uses of your time. Weird, right? As we’ll see in a second that’s more or less my point. Continue reading

I’m going to admit something few people know about me: I love arguing on the internet and engaging in sophisticated trolling. I’m certainly not the only person to feel this way, but I may be one of the few people to openly admit it. The public perception of online argument is that it’s at best a waste of time, inevitably self demeaning (see right), and at worst horribly antisocial and divisive. Since the people I argue with are always anonymous and present of their own free will, I really don’t give a shit about the later two points. But I would suggest that arguing on the internet and broader behavior of the same sort are actually one of the best uses of your time. Weird, right? As we’ll see in a second that’s more or less my point. Continue reading

Off-Road Finance Turns One By The Numbers

Off road finance turned one year old two days ago. That’s counting from the first post written specifically for the site. I posted a math puzzle I’d written for another forum two days earlier so I guess if you want to be pedantic the site is one year and four days old. Thus far it’s been an interesting experience, and overall a positive one. I thought I’d share a few numbers about how things have gone: Continue reading

Kelly Criterion Part 1: Maximize The Expected Value Of The Logarithm Of Your Wealth

If you’ve read my about page, you know I have some ill-defined ambitions to eventually create a proprietary trading firm. This is probably a five to ten years out kind of thing, so there are essentially no details around the idea. Just some broad philosophies, a few lessons learned from the failures of other firms, and a belief that trading in groups is better than trading alone. But there’s one thing about this hypothetical firm that I have already decided – what poster I’ll have on my office wall. I’m going to have to have it custom made, but that’s OK. It’ll be worth it. The picture will be the rather nerdy looking Bell Labs engineer you see at right – John L. Kelly. The text on the poster will be:

Maximize The Expected Value Of The Logarithm Of Your Wealth. Then reduce your bet size by a factor of 5.

Get Over It – They Already “Stole” Your Trading Strategy

New traders think about strategies in a very peculiar way. I started thinking about this today because I saw traffic from the following search term:

“is there anything i can do to protect my trading strategy”

Now, you may be wondering what this person wants to protect their strategy from. Marauding bandits? But maybe like me you’re not wondering, because you have (or had) the same anxiety. The possibility that you’ll go to great lengths to discover a wonderful trading strategy, only to have someone else learn about it from you and make all the money. This third party might learn your strategy because you told them, or more nefariously they might learn it without you knowing. For example your broker might watch your trades, marvel at your amazing profitability, deduce the underlying strategy, and then duplicate (or even front run) it.

Please, please, please stop worrying about all this. Continue reading